|

|

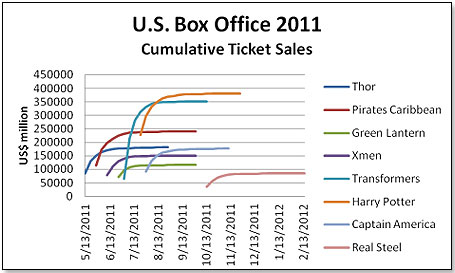

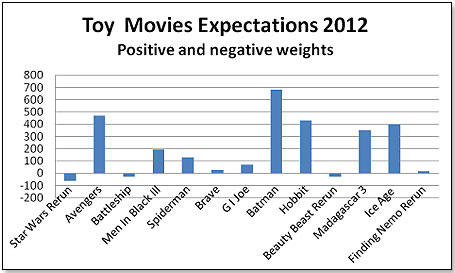

Movie Related Toy Sales in 2012 2012's box office results may affect toy sales for the better There is a stellar line-up of toy-related movies this year, probably the best in a long time, as it does not only focus on Boys (as was the case last year) but also has a very strong bias for Preschool and, to a lesser degree, Girls. There is a stellar line-up of toy-related movies this year, probably the best in a long time, as it does not only focus on Boys (as was the case last year) but also has a very strong bias for Preschool and, to a lesser degree, Girls.Movies can have a significant effect on toy sales and this is no better demonstrated than by looking at the Action Figure segment, which is virtually totally driven by movies such as Star Wars, Transformers, etc. In fact, movies were responsible for more than 50% of the Action Figure category sales in the U.S. last year. However, this does not mean that all movies are created equal. Most importantly, box office results are a major factor in determining the likely impact of a movie on toy sales. Secondly, timing of the movie is crucial in that you want to have as long a runtime as possible before another strong movie in the same genre hits the big screen and takes over. Thirdly, the audience the movie appeals to is a major differentiator in terms of resulting toy sales. Typically, movies focused on preteen boys tend to do best, followed by preschool children of both genders, and finally preteen girls. A movie can have a fantastic box office performance and a very long run time but if its main audience is adult males the impact on any toy fashioned after the movie will be minimal. The sales curve of last year’s toy movies demonstrates the importance of timing:  What this chart demonstrates is that the advent of a very strong movie totally stops its predecessor in its tracks. Thor was stopped by the Pirates, the Pirates were stopped by the Transformers, and they, in turn, were stopped by Harry Potter. That is why Harry Potter continued to see growing box office sales for a much longer time than its predecessors. The same picture emerges for Real Steel. Absent any subsequent competition, the movie happily continued to rack up growing ticket sales over a period of months longer than any of its precursors. Let us now turn to the 2012 movie/toy scene to determine how this year is likely to shape up. Firstly, European associates of mine very recently carried out consumer research to determine the perception consumers took away from watching a variety of movies with 2012 release dates and asked for a simple positive/negative – on the premise that the higher the score, the higher the box office was likely to be, and vice versa. The sample was several hundred and was evenly divided between the U.S. and the UK. This is how the scores shaped up for the major toy movies scheduled for 2012:  All reruns – Star Wars, Beauty and the Beast and Finding Nemo – had very low or even negative scores even though they were in 3D. These scores were in fact borne out by box office numbers. Reruns tend to disappoint. Yes, there is the theory that if you wait long enough, not only will the parents – who saw the movie first time around – want to visit it again, but also the children who never saw the original version would want to watch it. What this theory forgets is that time and tastes move on. What was a dramatic movie twenty years ago barely moves the needle in 2012 They then looked at the timing of these movies [2012/13] to determine the length of unimpeded exposure without competitive entries:

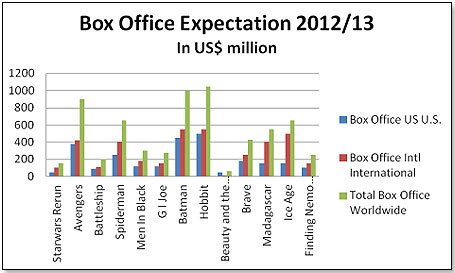

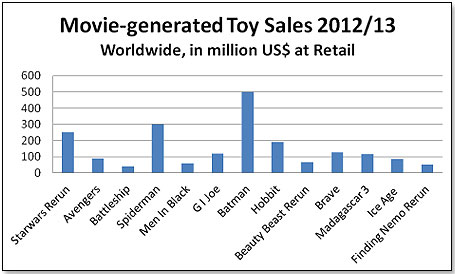

On this basis, Batman and the Hobbit have the best clear run times in the Boy Category. There is no issue in the Girl Category but very considerable conflict in the Preschool Category given the fact that the only unimpeded movie, Finding Nemo, is a rerun and hence unlikely to be much of a factor. Putting it all into the hopper, the researchers came up with estimates of box office revenue both in the U.S. and internationally:  In fact, Star Wars actual box office of slightly more than $100 million worldwide two months after release clocks in very closely to the estimate above. Presented with these findings, the national buyers at large retailers both here and in Europe were kind enough to offer their opinions of what they thought the sales potential was, taking into account the products they had seen at Toy Fair a few weeks ago. Scaling these opinions up to worldwide sales numbers results in the following estimates:  Batman is far and away the winner in the toy sales stakes, followed by Spiderman and the Starwars Rerun. The Hobbit, whilst expected to be a very strong film, comes in lower than its box office expectations suggest because the licensee, Bridge Direct, is a relative unknown and their promotional strength untested. Bridge Direct today has two licenses in the action figure field – Justin Bieber and the Power Rangers. Bridge Direct’s performance for both has been respectable but not enough to guarantee a real success for the Hobbit. The relatively low Avengers estimate is somewhat surprising given the blockbuster potential of the film. The buyers I queried on this offered the opinion that whilst the movie was new, the major heroes portrayed in it were not and that the overall effect of the movie on toy sales was therefore likely to be diluted. There are two major caveats to all these estimates, one negative and one positive. The negative is that movie audience numbers in the United States have been declining since 2002 and were last year more than 3% below 2010. The first two months of 2012 suggest a similar decline. Should the decline accelerate further then toy sale estimates would probably need to be revised. On the positive side, the buyers think that 2012 will be a significantly better year for toy sales than 2011. They base this assumption firstly on the quality of the new toys they saw at Toy Fair, secondly on the sharp increase in consumer confidence in February and thirdly on improving economic conditions. If trends as seen during the last few weeks continue during the course of this year into the fourth quarter, the estimates given in the Chart above could well be overly conservative. This would not only be nice but also overdue – the U.S. toy market has shrunk by nearly 8% in Dollar terms since 2003 and a turn to the better would be greatly appreciated by all.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.