|

|

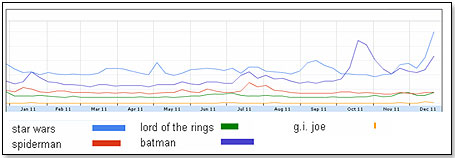

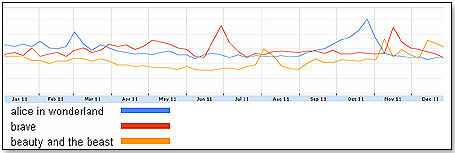

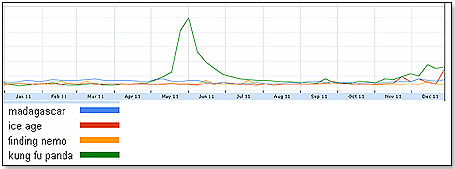

2012 Toy Movie Scene – Will it Differ from 2011?  The 2011 movie space in the U.S. was a disappointment. After a 6% drop in attendance in 2010, there was another drop of 5.3% this year. Virtually all toy movie sequels fell short of the box office results recorded by their prequels and virtually all movie-driven toy ranges sold below expectations. CARS2, Transformers, Captain America, Thor, Pirates and Green Lantern are cases in point. The 2011 movie space in the U.S. was a disappointment. After a 6% drop in attendance in 2010, there was another drop of 5.3% this year. Virtually all toy movie sequels fell short of the box office results recorded by their prequels and virtually all movie-driven toy ranges sold below expectations. CARS2, Transformers, Captain America, Thor, Pirates and Green Lantern are cases in point. There are a number of factors at work here. One is demographic. The toy movies by definition address a consumer group that is much more distracted by other pursuits than movie going – video games, social media, electronic interactions within their peer group, etc. The other is economic. Preteens depend on their parents for movie money and their parents are strapped for cash. The third is the quality of the movies themselves. Most of those we saw in 2011 were two-hour advertisements for toy products and not as good as they could have been. Are these factors going to repeat themselves in 2012? Given the incredible importance of films for the toy industry, it is important that we ask ourselves this question now. First, a look at what is coming down the pike in 2012. These are the movies on the road to us for next year, grouped into three major categories: Boys, Girls and Preschool. BOYS 02/10/2012 Star Wars Phantom Menace 3-D rerun The original Phantom Menace was released in 1999 with an astonishing box office receipt worldwide of $923 million. The most recent Star Wars movie was Clone Wars, released 8/15/2009, which was an unmitigated disaster with a worldwide box office of $68 million. The rerun of Phantom Menace is expected to do better because, for one, it is a better movie. The fact that it is a rerun could work in its favor in that it will be of interest to the generation that saw the movie thirteen years ago and the current pre-teens who see it for the first time. 63% of Rotten Tomatoes users rated this movie with 3.5 stars [out of a possible 5]. Hasbro is the toy master licensee and their worldwide sales of their Star Wars toys in 2012 are estimated at $250 million 05/04/2012 The Avengers This movie continues on from the 2011 releases of Thor, Captain America and Iron Man. All three super humans are recruited by The S.H.I.E.L.D. agency to help save the Earth from annihilation by extraterrestrial invaders. RTT News said in October that “when all is said and done, "The Avengers" might be the only other movie that could challenge "The Dark Knight Rises" and "The Hobbit" to be the top commercial hit of 2012.” 98% of Rotten Tomatoes users said that they wanted to see this movie. Hasbro is the toy master licensee and their worldwide sales of the Avengers toys are expected to clock in around $150 million. 05/18/2012 Battleship This movie is adapted from the Hasbro board game of the same name. The story line is that a fleet of ships is forced to do battle with an armada of unknown origins in order to discover and thwart their destructive goals. One of my Hollywood friends – whose business it is to assess commercial viability of movies – had a few problems with this one. Firstly, the movie has, in his opinion, absolutely no relationship with the board game. Secondly, he gave it thumbs down in regard to its quality. As Movie Moron put it, “The knives have been out for Battleship pretty much from day one, with the fundamental objection being that while the source board game might be an acceptable way to pass a rainy afternoon, it is threadbare material from which to fashion a movie”. Nevertheless, 83% of Rotten Tomatoes users said that they wanted to see this movie. Hasbro has the toy master license and any projection of 2012 toy sales is problematic. I would be inclined to put it down for $50 million in toys sales. As one national toy buyer put it – “I will take in whatever Hasbro puts out for it but I do not think the movie will make any great waves in my games department”. There could of course be a case of reverse engineering – instead of the movie taking its cues from the game, Hasbro might have decided to produce a totally new game based on the movie. 06/09/2012 The Amazing Spiderman The Spiderman series is one of the most successful movies from a commercial point of view. The most recent version, “Spiderman 3,” had a box office of $890 million in 2007 and grossed $300 million in toy sales. People who have seen trailers tell me that it is much darker and more brooding than its predecessors. This might well limit the movie’s commercial appeal. However, 94% of Rotten Tomatoes said that they wanted to see this movie. Hasbro is the master toy licensee and is expected to show sales in 2012 in the neighborhood of $300 million. 06/29/2012 G.I. Joe – Retaliation The first movie in the series – Rise of Cobra – was released on 8/17/2009 and it was somewhat of a disappointment both in terms of box office and of commercial sales. As for the former, it was generally considered a second-tier movie and IGN said that, “In fact, there is something rather admirable in Sommers' attempt to neither pander to his audience nor unnecessarily class-up the source material. The good guys are good guys; the bad guys are bad. The schemes are ridiculous and the characters are broad.” The movie also had the bad fortune of being totally overshadowed by a truly great boy-focused film – Harry Potter’s Half-Blood Prince – which was released about two weeks later. The general take by the movie gurus is that Retaliation is an improvement over the Cobra and hence should do better. 95% of Rotten Tomatoes users said that they wanted to see this movie. However, just like first time around, the movie is going to be overshadowed by a cinematic heavyweight – Batman, the Dark Knight rises – three weeks later. Hasbro is the master toy licensee and their sales next year are expected to clock in on the $100 million level.  07/20/2012 Batman – Dark Knight Rises 07/20/2012 Batman – Dark Knight RisesThe most recent in the series – The Dark Knight, released on 7/18/2008 – was one of the few Billion Dollar movies - $1.001 million. The next installment – The Dark Knight rises – is expected to top this number particularly since the movie will have a clear run until December when The Hobbit of the Lords of the Rings is released. One of the national buyers at a very large retailer who had seen the trailers and the toy prototypes thought that the movie was likely to be the single largest toy sales generator next year. 98% of Rotten Tomatoes users said that they wanted to see this movie. Mattel is the master toy licensee and their sales this year are expected to be well north of $400 million. 12/14/2011 Lord of the Rings – Hobbit’s Unexpected Journey The last film in the series – Lord of the Rings, Return of the King, released on 12/17/2003 – was a smashing success with a worldwide box office result of $1. 159 million. The master licensee then was now-defunct Toy Biz of Marvel. The 2012 movie has already been widely praised for its cinematic content. This is what CinemaBlend’s Eric Eisenberg had to say: “Though the preview didn't feature any epic battles or hordes of Orcs, what it lacked in action it more than made up for with beauty and an insane amount of nostalgia," he wrote. "Every shot in the trailer is breathtaking, from Bilbo Baggins wandering through the Shire to Gandalf in a fight against a mysterious creature. Everything about it is stunning.” 93% of Rotten Tomatoes users said that they wanted to see this movie. This time around, the toy master licensee is The Bridge Direct Inc., a company founded in 2009 and owned between Jay Foreman of Play Along fame and Oakhill Capital. The Bridge Direct already made its mark with Zhu Zhu Pets and Justin Bieber, and could become a major player in the action figure field with the Hobbit. The buyers I asked thought that the property could well exceed $400 million in shipments. A good insight into which films are of interest to consumers is to look at the searches ongoing on Google in relation to them:  On this basis, Star Wars and Batman are the clear winners, Lord of the Rings and Spiderman are tied for third place and G.I. Joe is nowhere. GIRLS 01/13/2012 Beauty and the Beast 3-D rerun The original movie was released on 11/15/1991 and had, for its time, a phenomenal box office result worldwide of $377 million. The rerun addresses a totally new generation of girls and might also attract a number of the 1991 audience. 92% of approved Rotten Tomatoes critics gave this movie thumbs up. I would expect it to do well. Mattel is the toy master licensee for the movie and I would rate the potential at about $150 million in worldwide toy sales. 06/22/2012 Brave Brave is a 3-D computer animated sci-fi movie by Pixar. Its main protagonist is a girl, Merida, who is an expert archer and who, by contravening old customs, is forced to battle a spell that threatens her world. 92% of Rotten Tomatoes users said that they wanted to see this movie. Mattel is the toy master licensee and I would rate the potential worldwide toy sales in the neighborhood of $100 million. Here again Google Search tells us which movies consumers are interested in – Alice is used as a control. Note that Alice broke on March 5 last year and racked up a box office of $1.024 million.  On this basis, The Beauty and The Beast as well as Brave can be expected to do very well, at least in box office terms. PRESCHOOL 06/08/2012 Madagascar 3 – Europe’s Most Wanted The last Madagascar – Escape to Africa – was released on 11/7/2008 and racked up a very respectable box office of $603 million worldwide. The master license was then apparently held by Hooga Loo LLC. This has changed over to Mattel as the toy master licensee. The movie is expected to do very well – 93% of the readership of Rotten Tomatoes want to see the movie. However, in terms of toy sales, preschool movies do not typically generate the same volume as films directed at older kids – e.g. the Transformers of this world. I would hence expect a toy sales volume worldwide well below $100 million. 07/13/2012 Ice Age Continental Drift The most recent Ice Age movie was Dawn of the Dinosaur, which hit the screens on 7/1/2009. It had a very acceptable box office result worldwide of $886 million and toy sales between $60 and $70 million. Mattel was then the toy master licensee as they are this time around. 91% of the Rotten Tomatoes users want to see it. Again here we have a preschool movie that is unlikely to generate high toy sales and my estimate is in line with last time around – between $60 million and $80 million 09/14/2012 Finding Nemo 3-D rerun Here again we have a 3-D rerun of a movie first released on 5/30/2003. Its box office worldwide was $867 million and its toy sales by Mattel, the then master toy licensee, estimated at $50 million. I assume that Mattel is also the toy licensee for the rerun. 91% of Rotten Tomato users said that they wanted to see the 3-D version. I expect sales to be approximately on par with those of the first version Google Search demonstrates the relative interest in these films as compared to Kung Fu Panda, which was released on 5/26/2011 and recorded $663 million in worldwide box office.   On this basis, Ice Age will do very well, followed by Madagascar at some distance. Finding Nemo does not look too good. On this basis, Ice Age will do very well, followed by Madagascar at some distance. Finding Nemo does not look too good.To come back to the headline question – will the toy movie scene be different in 2012? My sense is that Mattel and Bridge Direct will do better next year than they did this year because they hold the toy licenses for the blockbuster films Batman and Lord of the Rings. Hasbro will continue to dominate the boy category, but I believe that their overall 2012 offering is both in terms of box office and in toy sales probably a little light if compared to 2011. Mattel is clearly going to dominate the Girl and Preschool category, which should give a boost to their Disney Princess and Fisher Price business. Whether the film business overall will bounce back from fairly dismal 2010 and 2011 years will to a good extent depend on economics, but those films focused on the below-teen segment will in all likelihood continue to struggle, because the drift to other entertainment avenues doesn’t look like it will lose momentum anytime soon.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| ||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.