|

|

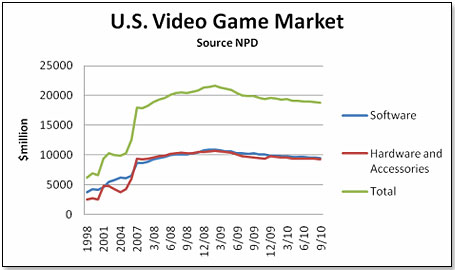

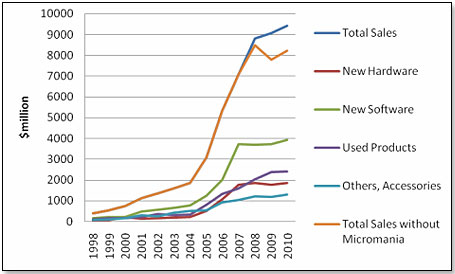

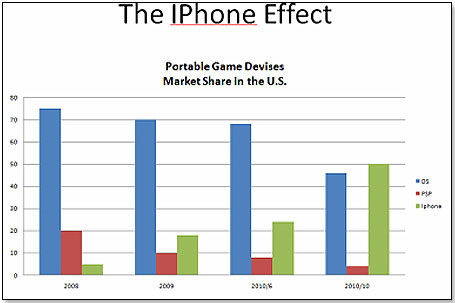

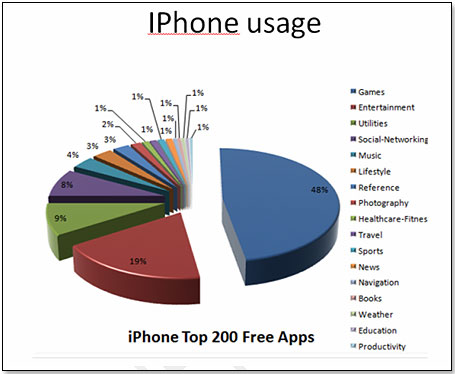

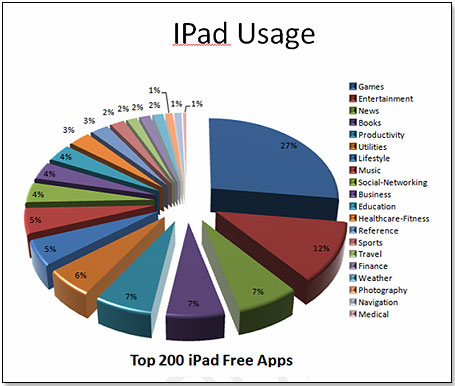

Quo Vadis GameStop? For many years, GameStop was the kingpin of the video game market. Not only were their stores the destination of choice for new consoles and games, they also were the place where gamers could buy and sell used games. In fact, GameStop had a virtual monopoly on this business and this showed in their profitability. On Consoles, they made less than 10%, on new games about 20% and on used games around 50%. They also benefited from the rapid growth the video game market enjoyed in the decade between 1998 and 2008. This growth was fuelled by the introduction of faster and better consoles that allowed gamers to play more and more challenging games. And so people bought more consoles and more games and where did they buy these? At GameStop, of course. There was a hiccup between 2001 and 2006 when the consumers knew that new consoles were on the way and held back from buying the old models. As soon as these arrived, the market took off like a rocket. We are now in the same part of the cycle. The consumers know that snazzy new consoles will come their way – with 3D, motion-sensors built in, sharper graphics and a few more bells and whistles – late 2012 or early 2013. In fact, as the chart below demonstrates, the consumers had begun to know about this as far back as January 2009.  In fact, GameStop’s business began to flatten out even earlier, in 2008.The reason for this is that a significant proportion of its consumers are very savvy hardcore gamers who, of course, would know well before anybody else that there were new consoles on the horizon. Management, well aware of these trends, sought to protect their flank by buying Micromania, France’s largest video game retailer, so as to ensure continued growth inspite of underlying trends:  Looking at stagnating sales should be bad enough but there are some more bad news for GameStop. And, as they say, bad news rarely come in singles. The first piece of really bad news was the ascent of the iPhone as a gaming platform. This is how the iPhone market share in the gaming space developed versus the two other handhelds – the DS and the PSP:  Today, nearly half of iPhone’s usage is for games and this trend seems to be continuing.  For GameStop, the bad news is that they do not sell the IPhone and hence not the games that go with it either. Then, this year, came the iPad. Again here, we look at a platform which is aggressively muscling into the game space and today 27% of its time is devoted to gaming. Exactly as in the case of the iPhone, GameStop neither sells the platform nor do they have a hand in the selling of the games themselves.  The second piece of bad news is the advent of OnLive – a technology that allows the consumer to play games in the cloud on a PC or a Mac or even on a TV screen. Particularly at a time when new consoles are in the offing but not yet here, OnLive represents a first-class stop gap. OnLive was in Beta testing during the twelve months ending in June this year and then went live. The technology is still held back somewhat by the fact that it requires a broadband speed of 5 MPBS versus a national average of only 2.5 MBPS. In effect, this means that the technology is only available to about one-fourth of the U.S. population. However, there is a very strong undercurrent in favor of accelerating the availability of much higher speeds on a much wider basis and with this, OnLive will also expand. The problem with OnLive as far as GameStop is concerned is that the technology effectively cuts out all brick-and-mortar retailers for both the consoles as well as the gaming software. The third piece of bad news is that GameStop’s used game business is coming under strong pressure from other retailers. To illustrate the importance of used games to GameStop, all we have to do is to look at how they make their money:

Used Games represent nearly half of GameStop’s income. This fantastic profit margin is a direct result of GameStop having a near-monopoly and when you have monopolies, you coin it. However, this is about to change. Two major retailers either have just entered the used game space or are in the process of test-marketing an entry. The first one is ToysRUs. Just like GameStop, ToysRUs has a dedicated Video Game space fully staffed. They began their test in five stores early last year and from then progressively expanded the number of stores until they now have used games in both their 587 permanent stores as well as their 600 pop-up stores. They are doing well and are projected to have 5% to 7% market share by end of this year. The second is BestBuy who began testing used games early this year and have now rolled this out to all their 1000 U.S. stores. They are projected to do less well than ToysRUs but nevertheless to have a market share of about 3% by end of this year. The third is Wal-Mart who began testing used games in five stores in May. This test went inordinately well and has meanwhile been expanded to about several more stores. I understand that they plan to roll this out to about 1000 supercenters during early next year if all test stores continue to perform well until end of this year. They will have a dedicated space for used games only, staffed with two game-savvy managers most of whom will have been recruited from GameStop. There are several more entrants but less potent ones. 7/11 is selling used games in about 5000 stores and Target has just begun to buy, not sell, used games. Neither is expected to make a major dent into GameStop under their current model The effect of these competitive activities will be two-fold. One is that GameStop will lose market share and hence sales. The second is that GameStop will, in order to minimize these sales losses, have to become more competitive and this means lower margins. I would not be surprised if the effect of both lower sales and lower margins did not half their used game profit generation next year. In summary, the combination of a stagnant market, competitive inroads, changing consumer patterns, and lower margins is pretty much the equivalent of a perfect storm from now onwards for GameStop. Unless they manage to morph into a model that accommodates these trends and fundamentally changes the equation, prospects for this retailer are likely to become dim..  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

|

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.