|

|

Barbie and Disney Princess Await Court’s Bratz Decision Mattel’s Dolls Stay on Top in Volatile Market

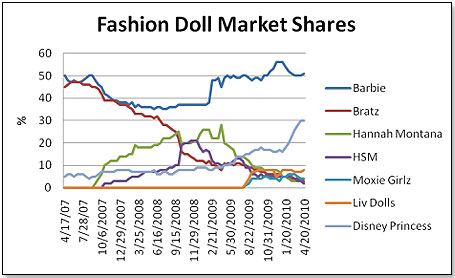

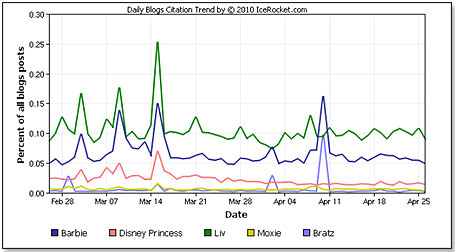

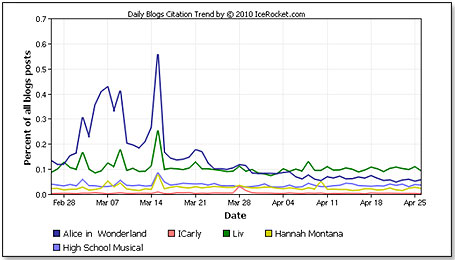

BARBIE COMES BACK This is how market shares of the major fashion doll brands developed in the United States between early 2007 and April 2010, as per my retail panel sell-through numbers:  The first comment that needs to be made is, Barbie is back. The Mattel brand, long on the defensive against MGA Entertainment’s Bratz, and inordinately affected by the KGOY [Kids Grow Older Younger] syndrome, has firmly reasserted itself. While Barbie’s market share suffered a slight decline in the first quarter this year, the brand has again stabilized on the +50-percent level and is expected to grow further in light of two developments: Disney’s “Toy Story 3,” which is expected to be the strongest preschool movie ever and which prominently features Barbie and Ken; and the assessment by the buyers on my panel that the KGOY syndrome has now run its course. (Why Toy Sales Will Strengthen But Won’t Beat ’03) What is also astonishing is the quiet but inexorable advance of Disney Princess. This doll range has now clearly established itself as No. 2 in the lineup and has inherited the mantle of Bratz. LIV SHOWS SIGNS OF LIFE  Of second-tier doll brands, the only one that seems to be getting some traction is Liv. I attribute this to two reasons: One, the range has better demographics than most; and two, buyers are apparently positioning the brand as a check on Mattel, which, between Barbie and Disney Princess, has an overpowering 72-percent market share. Liv is also a very good product and very nicely packaged. Of second-tier doll brands, the only one that seems to be getting some traction is Liv. I attribute this to two reasons: One, the range has better demographics than most; and two, buyers are apparently positioning the brand as a check on Mattel, which, between Barbie and Disney Princess, has an overpowering 72-percent market share. Liv is also a very good product and very nicely packaged. The other competitors are too small to be of any major significance at this point. Moxie does reasonably well at Toys “R” Us, but that is the extent of it. I looked at the blog sphere to determine which doll lines have the most resonance on the premise that this indicates consumer interest, and hence, presence or absence of future growth potential:   When looking at the two graphs above, please keep in mind that the scale of the curves is not identical between the two sets. That is why I included Liv in both. Two things stand out here. One is that Liv is clearly outstripping its competitors. The other is the tremendous impact of the “Alice in Wonderland” film. I also looked at the demographics of the various brands:

Clearly, Liv has the best profile in terms of the <24 years age group and clearly much better than either Barbie or Disney. Again here, Alice — though not as good as Liv — stands out in comparison with Barbie and Disney Princess and hence deserves a closer look. We have seen that Alice in Wonderland performed very well both in terms of blog sphere activity as well as in its demographics profile. It was also an astoundingly successful movie — the numbers below give box office results in the United States in $1,000 for the first seven weeks after release:

“Alice” had about the same box office result as the next five movies COMBINED. Yet, Mattel had only one “Alice” figure out — the Mad Hatter — at $59.99, and only at Toys “R” Us. The figure is still selling there and doing pretty well in spite of lack of support and an incredibly high price point. Why was a concept that so clearly fits in with Mattel’s long-term strategic interest — gaining back the pre-teen and teen girls that used to play with Barbie but now have migrated to electronics — not given the support, pricing, product depth and distribution it appears to have deserved? The DVD is slated for release in June, and perhaps Mattel will view that as an opportunity to give “Alice” the limelight it seems to deserve. Also, Halloween is a natural for the doll and may represent another opportunity for Mattel. So, how is the doll market likely to evolve during the remainder of the year? BRATZ HANGS IN THE BALANCE  The single most important issue is the forthcoming decision by the Ninth Circuit Court of Appeals in regard to the appeal lodged by MGA against the district court’s injunction that basically ordered MGA to remove Bratz from retail shelves by January 21, 2010, and to turn over all its Bratz trademark and other rights to Mattel. The single most important issue is the forthcoming decision by the Ninth Circuit Court of Appeals in regard to the appeal lodged by MGA against the district court’s injunction that basically ordered MGA to remove Bratz from retail shelves by January 21, 2010, and to turn over all its Bratz trademark and other rights to Mattel.The appellate court granted a stay of the district court’s injunction pending its decision on the MGA appeal. Interestingly, The Ninth Circuit panel questioned during oral argument whether the district court's remedy, effectively requiring MGA to turn over the Bratz line to Mattel, was appropriate. In so doing, they potentially hinted that the district court’s decision will not stand. An alternative remedy as suggested by the court would be some sort of royalty arrangement. The court also ordered the parties to participate in expedited mediation. The appellate court’s decision is expected to be handed down in May. There are two likely outcomes to this. The one Mattel would like is that the appellate court affirms the decision of the district court. This is unlikely to happen given the stance it has so far adopted. The second is that the appellate court dictates a royalty agreement that would allow MGA to continue selling Bratz but having to pay Mattel a percentage on sales. This is much more likely, but my sense is that Mattel will seek further appeal routes to keep the case going. It is in Mattel’s interest to keep Bratz in legal limbo since the major retailers, who have already tossed Bratz, are unlikely to take the doll back as long as the legal tangle continues. Also, MGA might just run out of money and go away. If MGA gets Bratz back, this will affect any market share projection to a major degree. Right now, Bratz still has about 3 percent market share in the United States. A newly invigorated Bratz in the hands of MGA would be likely to soar to a share of between 10 percent and 20 percent within a year — to the detriment of Barbie and Disney Princess. STORY UPDATE (8-4-2010): Ninth Circuit Throws Out Lower Court Order in Bratz Case. July 22, 2010 — The U.S. ninth circuit court has overruled a lower court decision transferring the Bratz doll business to Mattel. According to attorney Doug Masters of Chicago firm Loeb & Loeb, “The court found that the lower court made a series of errors in finding that the inventor of the popular Bratz dolls had assigned all his rights to his employer Mattel because he had begun work on the dolls during his employment, and then further compounded the error by order that the whole business be turned over to Mattel as a remedy.” The decision may make it difficult for Mattel to eliminate its competition in the doll category. See court papers. Also see The Battle Over Bratz.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.