|

|

Women and Tweens Flock to Nintendo’s Wii Consumer Demographics Distinguish Console from Competitors

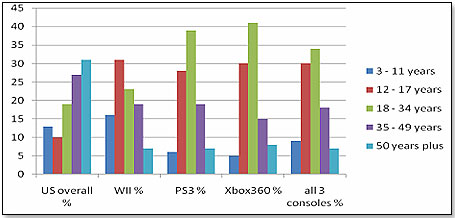

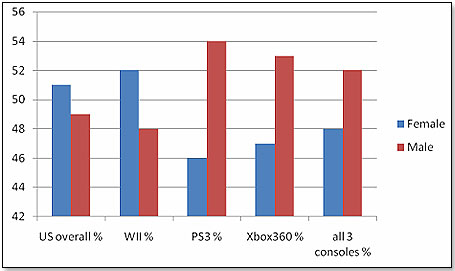

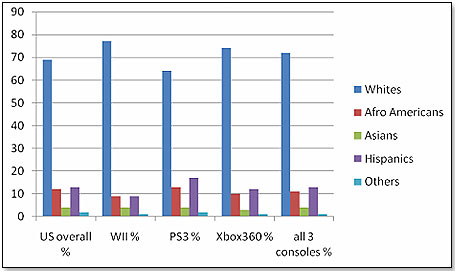

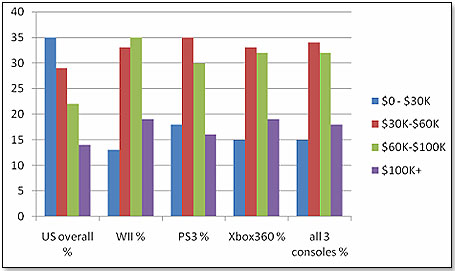

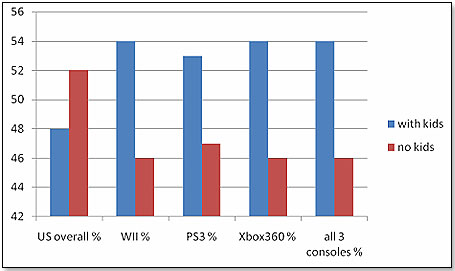

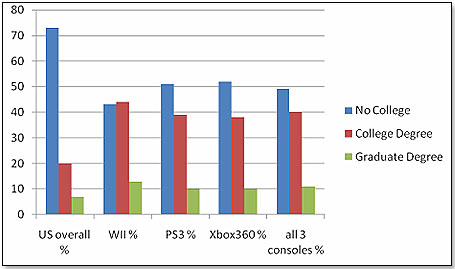

Demographic data suggest that Nintendo is the one company perfectly situated to take advantage of this structural shift in the games marketplace. The Wii has carved out a very strong position among the 17-and-under crowd, females, the affluent and the better-educated. This is really where you want to be with a technical entertainment product that not only requires a reasonably large investment but also depends on its consumers to buy fairly expensive software in regular intervals. At the same time the Wii manages to be very competitive toward the other two consoles in the remaining profile categories. I thought it timely to take a closer look at the Nintendo Wii consumer and how he or she is different from the Microsoft Xbox 360 or PS3 consumer. The information below is from Web traffic data of the three consoles, cross-checked with my friends at GameStop. I have also shown for comparison’s sake U.S. population data from the Census Bureau. Age Profile:  The Wii’s age profile is distinctly different from that of the other two consoles. It leads in both the 3 to 11 age group as well as, less significantly, in the 12 to 17 group, whereas the other two are very strongly biased towards the 18 to 34 group. None of the three have made significant inroads into the 35+ group. Gender Profile:  There is an astounding gender differentiation between the Wii and the other consoles. While the PS3 and Xbox 360 are heavily weighted toward the male gender, the Wii is exactly the other way around. Given the fact that females represent the majority of the population of the United States, this is particularly significant. This position did not come about by accident but rather as a consequence of a very targeted promotional policy since 2005. As a result, women and girls have been a growing segment of Nintendo’s success with the DS. They represented 30 percent of DS owners in 2005 and shot up to nearly half of all buyers in 2007. Over the past several months, Nintendo has been running TV ads with celebrities such as Carrie Underwood and Liv Tyler playing DS titles, including “Nintendogs” and “BrainAge.” Reggie Fils-Aimé, president of Nintendo, said sales of those titles and the new Super Mario Bros. have at least doubled since the ads started running in May. Nintendo is following the same policy in regard to the Wii, and it is obviously paying off. Racial Profile:  There are no real differences between the three consoles in that all three are heavily concentrated on whites. The PS3 has somewhat more of a distribution among non-whites, but this is not statistically significant. Income Profile:  The Wii is doing better among higher-income groups, and the PS3 has the highest percentage of the lower-income groups. Given the price of video game consoles, and of the PS3 in particular, this may well represent a problem area for the Sony product over the longer term, particularly given today’s economic environment. Family Profile:  Contrary to the current distribution among the general population, all three consoles are heavily weighted toward families with kids as opposed to singles or families with no kids. This goes against conventional wisdom, which always held that the gamer in the PS and Xbox group was a single male. Educational Profile:  The Wii has the highest educational profile, and the other two are much more heavily weighted toward consumers with no college degree. The Wii profile would be even more extreme if one left out the 3- to 17-year-old age group. These charts bear out the contention given in the text box above — that the Wii not only competes very forcefully in demographic segments normally considered the province of the Xbox and the Play Station, but, in addition, has a very strong edge among the more affluent, the younger, and the better educated. Among females, the Wii has a virtual monopoly. The graphs also demonstrate that there is one demographic waiting to be penetrated — the older age group.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

|

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.