|

|

The Emergence of a German Toy Giant Will Smoby’s Fate Make Simba-Dickie Great?

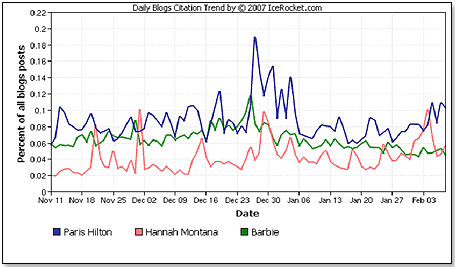

Not that Simba Dickie isn’t a big boy itself, with $560 million in worldwide sales in 2007, up from approximately $317 million in 2003. The company has about 1000 employees worldwide, and half of its sales volume is outside Germany.  Growth has traditionally been due to acquisitions: Eichhorn in 1997; diecast manufacturer Schuco in 1999; toymaker Noris in 2001; and then plush manufacturer Nicotoy and model plane-maker Schabak in 2006. Growth has traditionally been due to acquisitions: Eichhorn in 1997; diecast manufacturer Schuco in 1999; toymaker Noris in 2001; and then plush manufacturer Nicotoy and model plane-maker Schabak in 2006.At this point, the group covers most areas of toys — fashion and other dolls, baby toys, play sets, musical toys, vehicles, wooden toys, outdoor toys, model planes and board and card games — through a variety of brands. Is it time for another acquisition? RECENT MONTHS SEE MOVEMENT Simba-Dickie has been exceptionally busy during the last few months: • Entered into a joint venture with the Danish candy maker Dracco to develop candy toys • Won a court case against Mattel, which had challenged its rights to Disney’s Cinderella brand (for which Simba-Dickie bought the license in 2000)  • Launched Jamil, an Arabic fashion doll, through Carrefour throughout the Middle East and is now No. 2 (after Barbie) in the Middle-Eastern fashion doll category • Entered into a joint-venture distribution agreement in Russia, a toy market that grew approximately 30 percent in 2007 • Foreseeing production shortages in China, bought the majority of two of its key suppliers in Shenzhen and Donguan • Signed a worldwide license agreement with Paris Hilton and began to develop with her a line of fashion dolls • Entered the fray to wrest control of Smoby, France’s leading toymaker, from MGA  PARIS BRINGS STRENGTH PARIS BRINGS STRENGTHI looked at Paris Hilton’s interest levels in the USA, UK, France, Italy and Germany, versus leading babes Barbie, Bratz and Hannah Montana. According to Google searches, Hilton was neck to neck and competing for the top spot with Barbie in Germany, a very strong second after Barbie in Italy and France, and a distant third (but still ahead of Bratz) in the UK and the USA. The German strength is particularly interesting. Bratz went up against Barbie last year in Germany and became a real cropper — just walked into a wall. Google searches suggest that Hilton would be a stronger contender there and a real threat to Barbie. Blog Intensity Metrics suggest that Hilton is potentially very strong in the USA as well:  Simba Toys has a legal entity in the United States, but distribution responsibilities are with German toy company Ravensburger, out of its New Hampshire office. Simba’s products are currently not sold by the big three but are in fair distribution in specialty. BANKRUPT SMOBY BREEDS OPPORTUNITY Despite being France’s largest toy manufacturer (and No. 2 in Europe after UK’s Vivid), with a 2007 sales volume estimated at about $600 million, Smoby declared the French equivalent of Chapter 11 in March 2007. Because it made too many acquisitions too fast, the company found itself in an extremely heavy debt load of nearly $500 million, and as a result, with debt service charges it simply could not carry. Smoby ranks as the French market leader in outdoor toys, play sets and soccer tables, for which it claims to be No. 1 worldwide. It is also very strong in playground toys, garden toys and die-cast vehicles, which rank No. 2 or No. 3 in most major European markets. TRYING TO TOPPLE MATTEL  MGA selected Zapf as its acquisition vehicle to dislodge Barbie in Germany in a campaign that was planned for 2007. And Smoby, which was strong in die-cast throughout Europe, represented an opportunity to attack Mattel’s second largest category, Hot Wheels, in France in 2008. MGA made a deal with Smoby whereby it would acquire 70.5 percent of the voting rights and more than half of the share capital for Euro 1. Part of the deal was that MGA would inject enough new capital to get the French courts’ approval for the acquisition. They made a first payment of 29 million euros but did not come through with the balance. So the French courts opened Smoby to other bidders, which is where Simba-Dickie comes in. SIMBA CLIMBS WHILE MGA FALLS  The acquisition of Smoby would grant Simba-Dickie sales of more than $1.1 billion, making it the sixth-largest toy manufacturer worldwide, just after Lego. The development of the Paris Hilton fashion doll range and the acquisition of Smoby would put them in a very strong position to enter the U.S. market. The partnership with Dracco could help, since the candy company is doing exceptionally well in the United States. The acquisition of Smoby would grant Simba-Dickie sales of more than $1.1 billion, making it the sixth-largest toy manufacturer worldwide, just after Lego. The development of the Paris Hilton fashion doll range and the acquisition of Smoby would put them in a very strong position to enter the U.S. market. The partnership with Dracco could help, since the candy company is doing exceptionally well in the United States.MGA’s European strategy is unraveling. Zapf continues to lose money, the German anti-Barbie strategy went nowhere, and MGA lost the Smoby deal. With Bratz under attack in the U.S. from both Barbie and Hannah Montana, the last thing the company needs is another competitor — namely Simba’s Paris Hilton toy range — to make its life difficult.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| |||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2025 PlayZak®, a division of ToyDirectory.com®, Inc.