|

|

Is All This Talk About Webkinz Good? Top-Six “Virtual Playgrounds” Face ChallengesHow are the six top virtual playgrounds doing? Virtual playgrounds are a fairly recent phenomenon. While there are now hordes of them out there, there are really only six that matter as far as the toy space is concerned. There is potentially a seventh contender — www.buildabearville.com — but this playground just started and it is too early to get any meaningful traffic numbers.

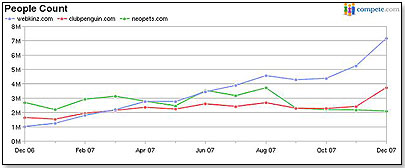

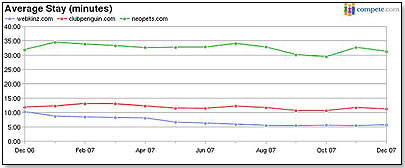

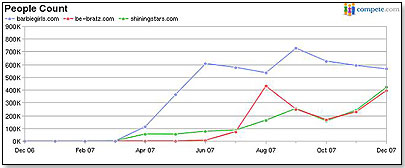

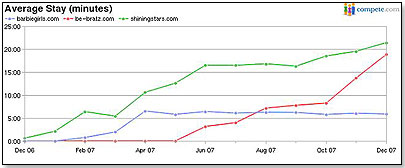

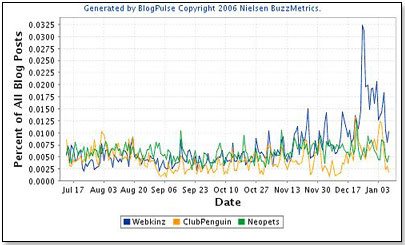

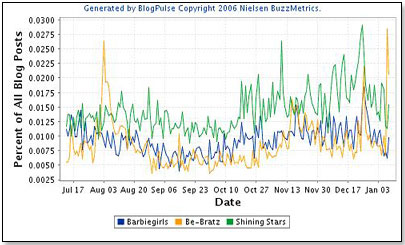

Since all six websites are totally Internet-driven, I will assess their performance accordingly. 1. Interest by Non-users The first metric of interest is that of people trying to find the site. They obviously are not yet users or they would know the accurate domain name. Google has recorded the following searches for the top three brands over the past 12 months: • Webkinz is clearly on top and increasing its lead over both Club Penguin and Neopets and shows clearly seasonal peaks typically associated with toys. The latter two show a low level and flat rate of searches. • As to the second group, which is considerably lower in terms of number of searches, Shining Stars outstrips the other two. Be-Bratz started off very strongly, then flagged and in December recovered again. Barbie Girls started off very sharply but then stagnated. All three show a pronounced seasonal spike before Christmas and a similar drop in interest after Christmas. The line for Barbie Girls is particularly interesting. Bob Eckert, the CEO of Mattel, profiled Barbie Girls as Mattel’s best opportunity to get the tween girls back to Barbie. After a very promising start, the follow-up is not there and I would doubt whether the tween girls are really coming back. 2. Web Traffic The next metric demonstrates what is happening on the websites themselves. First, how many individual visitors are calling on the sites of the big three:  Obviously, a lot of the initial interest as demonstrated under Pt. 1 above translated into increasing visitor numbers for Webkinz. I would worry if I were Jakks with Neopets because obviously the site has considerably less traffic today than it had a year ago — by about 20 percent. Club Penguin is showing renewed strength after the acquisiton by Disney. However, visits are one thing; what people do when they are on the site is another:  What this shows is that the Neopets customers spend about double the time on the site than the other two. Club Penguin is fairly steady and Webkinz is declining; the average visitor stayed 10 minutes a year ago and now stays only five minutes. As for the next three sites:  All three started about the same time. Barbie Girls took off like a rocket, hit a plateau in June, took off again and hit a high in September, and has declined since then. Shining Stars have been on a tear since the start — and so has Be-Bratz, since October. Average length of stay also tells us something:  Both Shining Stars and Be-Bratz are doing exceptionally well, whereas Barbie Girls has plateaued. 3. Blog Metrics Blog Metrics basically measure the incidence in which a product is discussed on the Web. This can demonstrate both positives (e.g., increased interest) as well as negatives (e.g., criticism). A recall would, for instance, engender the latter. As for the first three brands:  This suggests that Webkinz hit a nerve during the second part of December. This was the time when Ganz made the headlines: A recall, a suit by the Department of Health of Vermont, negative consumer reaction because of advertising on the site, etc. This subsided relatively quickly but is still fairly high. The other two had a fairly consistent noise level . As for the other three brands:  Again here, Shining Stars was the highest performer and not because of negative publicity. Be-Bratz tracked Barbie Girls very closely until the very end of the year when the noise level began to skyrocket. 4. What does this all mean? On the basis of these metrics, I would assess the performance of the six brands as follows: Neopets: The low curiosity level by non-users has already begun to affect Web traffic. However, the users that do come tend to stay on the website for a long time, which suggests a solid core consumer group. There is sufficient traffic on the blog highway to show that those that are familiar with the website are interested in it. However, Jakks will need to find ways to stimulate increasing new visitor intake or the website will decline at an increasing rate. Club Penguin: The low and static curiosity levels by non-users has not yet begun to affect web traffic that is still solid and level. Here again, we have a steady and medium blog noise level, which suggests underlying conversations but no excitement. Disney will need to find ways to feed the website with newcomers and to generate the excitement that is now lacking and that is essential for a virtual playground concept. Webkinz: The brand has a very high and increasing curiosity level by non-users that is feeding a high and increasing Web traffic (both of which may be due to controversy surrounding the brand of late and which, therefore, is not an unalloyed positive). The low and declining stays on the website itself are definitely a negative and will need to be addressed with better website contents. The very erratic blog noise level is typical of a brand that has problems: recalls, lawsuits and the like. Barbie Girls: I think that the brand is in trouble. There is a declining trend on the non-user level, web traffic is declining, stay on the website is declining and noise level is static. Shining Stars: In contrast, this brand is doing well. There is a high and increasing curiosity level by non-users, Web traffic is increasing on a high level, and there is a lot of excitement on the blog highway. This latter aspect, in the absence of negative news, is a positive. Be-Bratz: The brand is not too successful in attracting non-committed onlookers to the website but is successful in convincing those onlookers that make the jump to stay with it. Web traffic is on a solid level and increasing as is the stay level. Noise level indicates excitement surrounding the brand which, since it is not triggered by negative news, is a positive.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2026 PlayZak®, a division of ToyDirectory.com®, Inc.