|

|

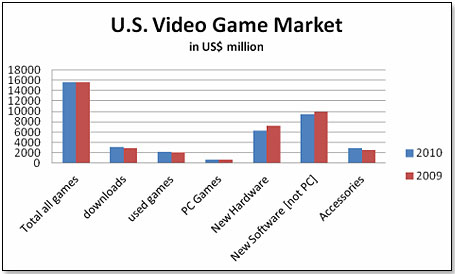

Where is the video game market headed? 2010 was the second year in a row of so-so video game sales. This is how the various components stacked up in 2009 compared to 2010:  All new store-bought products decreased whereas downloads and used games went up. The breakdown:

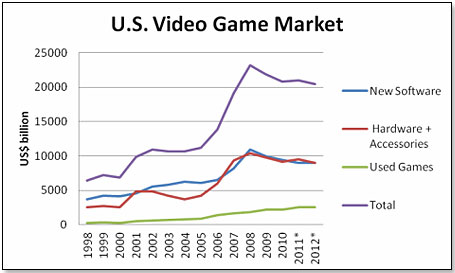

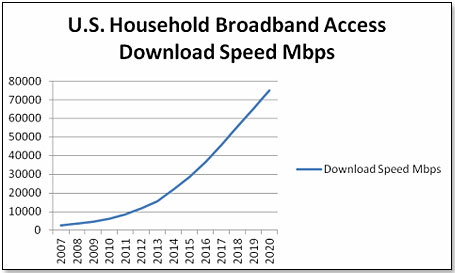

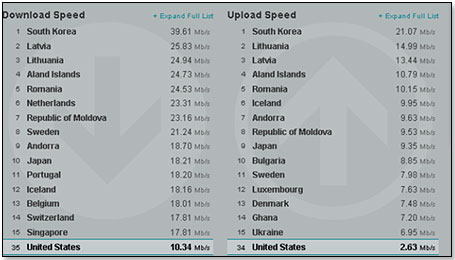

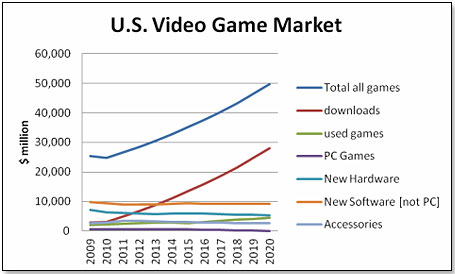

It has been a truism for a while that video game hardware sales are totally cyclical, and the cycle is determined by new introductions. What typically happens is that the future release dates of new generation consoles are signaled quite a number of years ahead of time, which leads to a flattening or even decline in sales during the intervening years. The last time this happened was between 2001 and 2005. The Xbox 360 was released in November 2005 and both the Wii and the PS3 in November a year later. The market took off like a rocket until the end of 2008 when the advent of next generation consoles became an increasing topic for discussion in gaming circles. Today, we are in the middle of the trough until the next consoles hit the market, which is expected to be no earlier than 2013. This is how this has played out historically:  As you can see, the period between console generations not only affected the sale of new consoles but also that of software and accessories. The only major store-bought category which continued to sail merrily along, come rain or shine, were used games. However, unlike the last trough, this one is likely to last much longer and be much more severe. There are a number of other influences that will have a profound effect on the video game market. Two of the major causes are 1) increasing broadband speeds, which will cut into retail sales, and 2) the rapid rise of mobile platforms such as the iPhone and the iPad, which take consumers away from consoles. The broadband speed determines how fast you can download a game over the internet. For instance, one of the most popular shooters – Call of Duty Black Ops – has a file of 7.39 gigabytes and takes 2 hours 13 minutes to download if you have a broadband speed of 10 mbps [mega bits per second] and 4 hours 36 minutes at a rate 4 mbps. Currently the average broadband download speed in the United States is 6.198 mbps and you are hence looking at about 3 hours. In comparison, installing the game from a disk takes about 20 minutes. This explains why the vast majority of games are still bought in disc form from retailers. Since there is considerable evidence that faster broadband speeds result in a higher incidence of internet downloads, it is interesting to note that this metric is about to undergo a fundamental change in the United States. Approximately 200 million Americans now have broadband access at home and Congress directed the FCC to develop a National Broadband plan to ensure that by 2020 90% of all Americans will have access to 50 – 100 mbps download speeds. Taking the average of the two numbers, this is how speeds are likely to develop:  While this is pretty good, the United States has a far way to go given a comparison to other countries.  Considering that Korea now plans to accelerate broadband download speeds to 1000 mbps [or 1 gmbs] by 2012, we still have ways to go. However, there is little doubt that increasing download speeds result in increasing migration from store-bought games to those downloaded. Download speeds doubled in the two years of 2009 and 2010 and so did game downloads. This trend will continue to be fostered by the video game publishers who are actively pushing the conversion from retailer-bought games to the internet. Their motivation is a very strong one: Games downloaded via the internet cost less to make. You have no packaging and no transport costs, and games downloaded from their websites cut out the retailer and hence the retailer margin, which is typically 20% of the selling price. Games downloaded cannot be pirated. In 2010, for every legitimate copy of a popular game sold, up to nine copies were sold by pirates. Games downloaded via the internet cannot be resold as is the case with hard copies sold by the retailers. It will not only be publishers who will benefit from greater download speeds. Companies such as OnLive and Gaikai who have developed a technology whereby you can download games onto any PC or Mac or TV set will equally benefit. What does this mean for the video game industry in general, and for video game retailers in particular? Michael Pachter, a highly respected video game analyst for Wedbush Morgan Securities, has predicted two things. One is that the video game market in the United States will grow by at least 7.2% yearly until 2020, at least doubling in this decade. The other is that all this growth will come from downloads. Taking this prediction and extrapolating the trends for the various components of this market place results in the following picture:  Or, to put 2010 and 2020 side by side:

You will notice that all components other than downloads and used games show a flat or negative trend. Obviously, a move into downloads will reduce the need for new games bought from the retailers. As OnLive, Gaikai and others gain traction, this will affect the demand for new hardware and accessories. The used game sector is likely to be an exception, at least during this decade. There is an inordinate amount of Xbox 360, PS3 and WII consoles out there now and their number will be augmented by new purchases of this generation and next generation consoles. The new consoles will continue to be backwards compatible. As a result, the used games market is likely to continue to grow just as they did during the last trough. Eventually, of course, as new software sales from the stores dwindle, used games sales will also begin to decline, but this is still a fair ways off. At this point in time, GameStop continues to be the totally dominant provider of used games with a market share somewhere north of 80%. Because of this near-monopoly, used games are a very major source of profit for the company – in fact, GameStop makes more than double on used games as compared to new games. It is therefore not totally surprising that competition is beginning to emerge and there are several companies competeing for the 20% or so market share not taken by GameStop. Hastings Entertainment, in business since 1968, is probably the largest used video game brick-and-mortar retailer after GameStop, but its market share is probably well below 1%. However, they are owned by the very powerful Mamaduke family and hence could represent a wild card. Redbox specializes in rentals and just announced their millionth rental but is not really a factor in game sales other than providing a testing ground for somebody who thinks about buying a used [or new] game and wants to see how it works. GameFly, too, specializes in rentals and has 300,000 users and also represents a good pre-purchase alternative. Amazon and EBay entered the fray several years ago and now command market shares of about 10% and 5%, respectively. In addition, Wal-Mart, BestBuy and Toys"R"Us began last year to market used games in earnest. They are still struggling and are expected, between them, to capture this year a market share of around 1%. However, I would not count them out. All three are very powerful companies, with lots of money, lots of highly intelligent people, and lots of determination. So they will persevere and in time become real competitive factors. Facilitating this development is one company, GTTI [Game Trading Technologies – GMTDD] who specialize in one absolutely essential aspect of used game retailing: supply chain management. To buy used games and to sell them is relatively easy, and lots of companies have tried and failed in the short order. The really difficult part is making sure that the right game is bought at the right price in one location and becomes available in the right quantity at the right time and the right price at another location. To get full product life cycle management right in terms of valuation, acquisition price, processing and reconditioning, and finally re-distribution and determination of selling price, is very difficult given the plethora of titles out there, and is the one factor which led to the death of many former efforts by large retailers entering this minefield. GTTI provides this service now to Wal-Mart, Best Buy, 7-11 and Toys"R"Us. All five have now been in the used game market for a while and the system seems to work very well. So far, this is where used games are sold in the United States:

The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

|

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2026 PlayZak®, a division of ToyDirectory.com®, Inc.